Benefits of Down Payment Assistance Programs

You may be able to qualify for a home loan with little - or even no - money down. Pairing that with down payment assistance can help you:

✅ Lower monthly payments

✅ Increase your home-buying budget

✅ Start building equity sooner

✅ Purchase a home sooner

Lower your mortgage costs

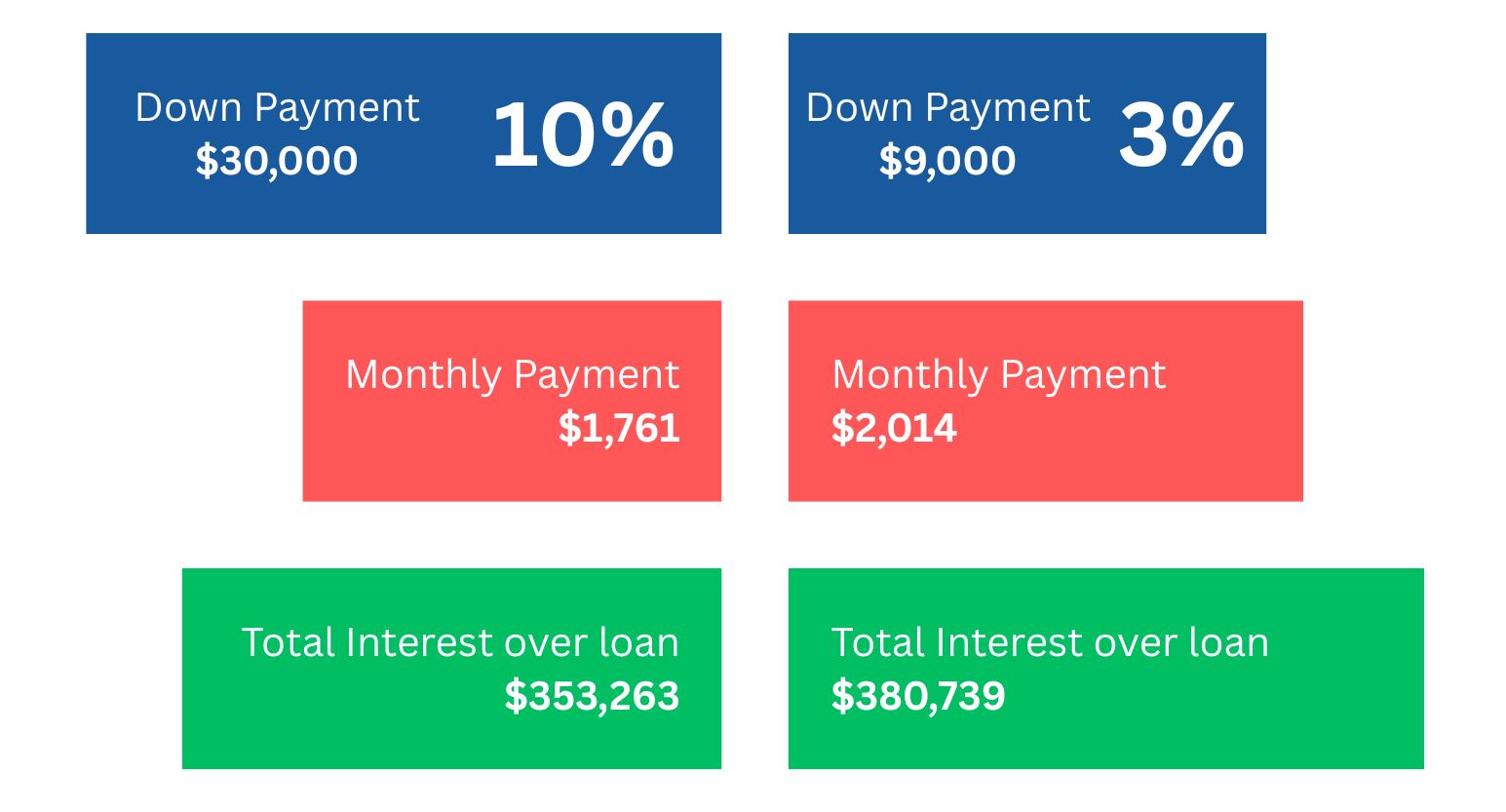

Cost of $300,000 home with a 30-year mortgage at 6% APR

* Sample payment shown for illustration only. Actual rates and payments vary based on your loan terms, taxes, and insurance.

See if you're eligibleSteps to qualify for down payment assistance

1. Provide Qualification Information

With our easy questionnaire, see if you qualify for down payment assistance.

2. Explore DPA programs

We'll help you find the information to choose the program that works for you.

3. Talk to your lender

Discuss the programs you're interested in and verify whether they offer them.

4. Complete requirements

Reqiurements vary by program, but many ask you to complete a homebuyer education course.

How to qualify for down payment assistance

Program availability varies by area, and several eligibility factors are considered:

Household income

Household size

Employment

Home ownership history