2025 Mortgage Rates Forecast: What Buyers Need to Know

2025 Mortgage Rates Forecast: What Buyers Need to Know

After a rollercoaster ride in recent years, mortgage rates are finally showing signs of relief for homebuyers across North America. According to AXEN Realty’s latest forecast, rates are expected to dip to around 5.5% by mid-2025. This shift could open doors for many buyers who’ve been waiting on the sidelines for the right moment to jump into the market.

Rate Predictions

Mortgage rate forecasts for 2025 offer a welcome dose of optimism. Early in the year, the 30-year fixed mortgage rate is projected to hover near 6.2%. As economic stability improves, rates are expected to ease, settling around 5.5% by summer. This gradual drop means buyers will see more favorable loan terms as the year progresses. For those considering shorter terms, the 15-year mortgage option may become especially attractive, with rates potentially dipping to 4.8%. Lower rates on both loan types create real opportunities for cost savings and flexibility in your home financing journey.

Impacts on Buyers

What does this mean for your wallet? A drop in rates translates directly to lower monthly payments. For instance, on a $300,000 home, the anticipated decline could save buyers roughly $200 per month. Over the course of a year, that’s $2,400 back in your pocket—money you can put toward home improvements, savings, or everyday expenses. Even more, these lower rates increase your purchasing power, especially in markets where homes typically sell within 60 days. With more affordable payments, buyers may qualify for larger loans or more desirable properties, making it a strategic time to enter the market or move up to your next home.

Why Are Rates Dropping?

The Federal Reserve’s efforts to tame inflation are starting to pay off, with economic indicators pointing to a more stable environment. As inflation cools, lenders are able to offer lower rates, making mortgages more accessible. Experts believe this trend will continue into 2025, bringing welcome news for both first-time and move-up buyers.

Timing Your Move

With rates expected to fall, some buyers may wonder whether to wait or act now. The answer depends on your situation. If you find a home you love and can afford the payments, locking in a lower rate sooner rather than later could be a wise move. On the other hand, if you’re flexible, watching the market over the next few months might yield even better opportunities.

Tips for Navigating 2025’s Mortgage Market

- Get pre-approved early: This gives you a competitive edge and shows sellers you’re serious.

- Work with a trusted lender: Rates can change quickly—having a professional on your side helps you act fast.

- Consider refinancing: If you bought recently at a higher rate, keep an eye on the market for a chance to lower your payments in 2025.

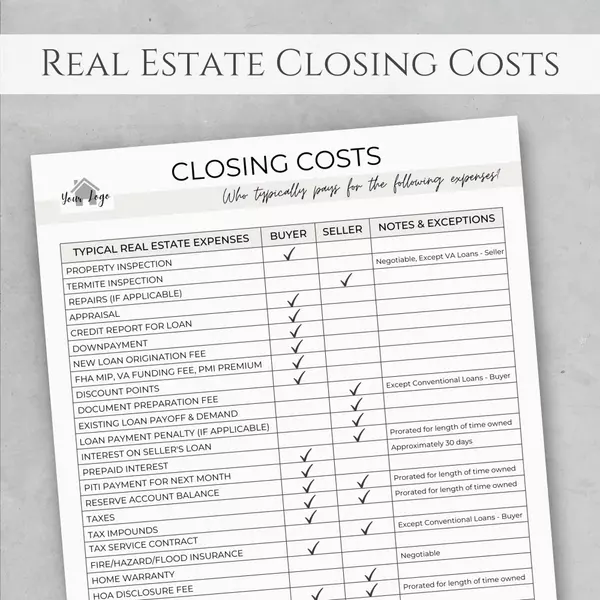

- Budget for the long term: Even with lower rates, factor in taxes, insurance, and maintenance costs.

The Bottom Line

The 2025 mortgage rate outlook is brighter for buyers, with lower rates poised to boost affordability and confidence. Whether you’re buying your first home or making a move, staying informed and prepared will help you make the most of these market shifts.

Conclusion

Forecast your mortgage future with AXEN Realty. Ready to see what you qualify for? Get pre-approved today and secure your place in the 2025 market!

Recent Posts