Understanding Closing Costs: Buyer's Financing Breakdown

Understanding Closing Costs: Buyer's Financing Breakdown

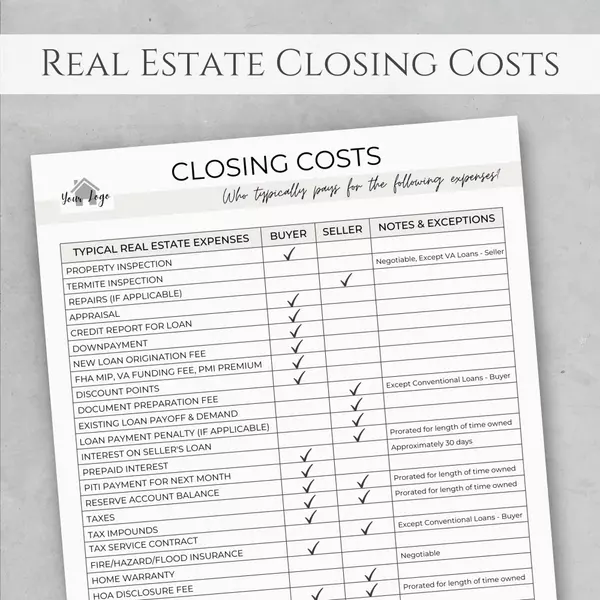

When you’re buying a home, closing costs can feel like the final hurdle between you and your new front door. These costs typically average 2-5% of the home’s price. For a $300,000 property, that’s between $6,000 and $15,000—an amount that’s important to plan for as you budget your move.

Common Fees

- Appraisal ($500 per property): Before your lender approves your mortgage, they’ll require a professional appraisal to determine the home’s fair market value. This ensures you’re not overpaying and protects the lender’s investment. Appraisal fees usually run about $500 but can vary by region and property type.

- Title Insurance ($1,000 average): Title insurance protects both you and your lender from any legal disputes over property ownership. It’s a one-time fee, often averaging around $1,000, that gives peace of mind and ensures your claim to the home is secure.

Ways to Reduce

- Shop lenders for lower fees: Not all lenders charge the same processing or origination fees. Take time to compare different lenders, ask for detailed loan estimates, and look for hidden charges. Even a small difference can save you hundreds at closing.

- Negotiate seller concessions: In some markets, you can ask the seller to cover a portion of your closing costs as part of your purchase agreement. This can be especially helpful for first-time buyers or those working with a tight budget. Your real estate agent can help you navigate these negotiations to maximize your savings.

Conclusion

Understanding and preparing for closing costs helps you step into homeownership with confidence. With AXEN Realty by your side, you’ll get transparent guidance every step of the way. Want to see what your closing costs might look like? Use our Cost Calculator and close confidently!

Recent Posts

Understanding Closing Costs: Buyer's Financing Breakdown

Down Payment Assistance Programs Nationwide in 2025

How to Improve Your Credit Score for Better Mortgage Rates

FHA vs. Conventional Loans: Which is Right for You?

2025 Mortgage Rates Forecast: What Buyers Need to Know

Selling in a High-Interest Rate Environment: 2025 Tips

How to Price Your Home Right in a Shifting Market

Home Staging Tips for Maximum Value in 2025

2025 Seller's Market Trends: When to List Your Home

How to Budget for a Home in a High-Interest Rate Market