FHA vs. Conventional Loans: Which is Right for You?

FHA vs. Conventional Loans: Which is Right for You?

Buying a home in 2025 means navigating a maze of mortgage options, but two of the most popular choices—FHA and conventional loans—stand out for their unique benefits and requirements. Whether you’re a first-time buyer with limited savings or a seasoned homeowner looking for the best rates, understanding the differences can help you make a confident, informed decision.

FHA Pros/Cons

- Low 3.5% Down Payment: FHA loans are famous for making homeownership accessible with just 3.5% down, a lifesaver for buyers with modest savings.

- Mortgage Insurance Premium (MIP): The tradeoff? FHA loans require an annual MIP, which typically adds 0.85% of your loan amount to your yearly costs. This can add up, so it’s important to weigh the long-term impact.

- Ideal for Lower Credit Scores: If your credit score falls between 580 and 620, FHA loans are often your best bet. They’re designed for buyers who might not qualify for stricter conventional standards, opening doors for many first-timers.

Conventional Advantages

- No Private Mortgage Insurance (PMI) Over 20% Down: One of the biggest perks of a conventional loan is the ability to avoid PMI once you put down at least 20%. This can mean significant monthly savings over the life of your loan.

- Competitive Rates in 2025: With average rates around 5.5% this year, conventional loans are more attractive than ever for buyers with solid credit and larger down payments. These lower rates can translate to thousands saved over time.

- Flexibility for Stronger Borrowers: If you have a higher credit score and steady income, conventional loans often reward you with better terms, fewer fees, and more loan options.

Conclusion

Choosing between FHA and conventional loans comes down to your unique financial situation, credit history, and long-term goals. At AXEN Realty, we’re here to help you compare your options and find the perfect fit for your next home purchase. Ready to take the next step? Loan Comparison

Recent Posts

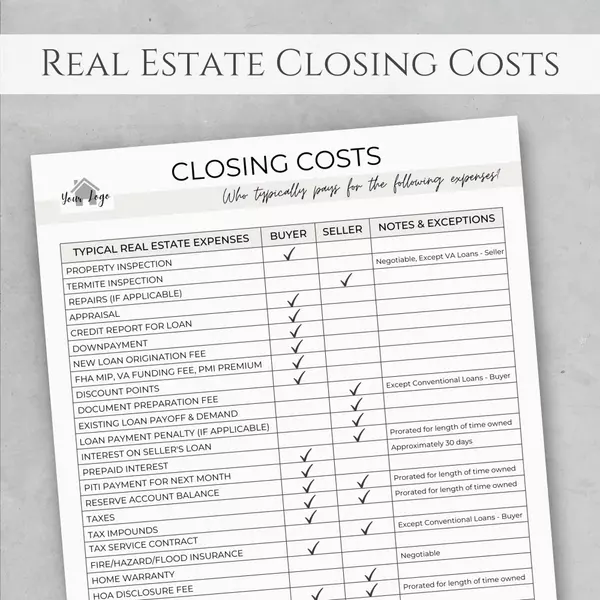

Understanding Closing Costs: Buyer's Financing Breakdown

Down Payment Assistance Programs Nationwide in 2025

How to Improve Your Credit Score for Better Mortgage Rates

FHA vs. Conventional Loans: Which is Right for You?

2025 Mortgage Rates Forecast: What Buyers Need to Know

Selling in a High-Interest Rate Environment: 2025 Tips

How to Price Your Home Right in a Shifting Market

Home Staging Tips for Maximum Value in 2025

2025 Seller's Market Trends: When to List Your Home

How to Budget for a Home in a High-Interest Rate Market