First-Time Homebuyer Checklist 2025

First-Time Homebuyer Checklist 2025

Buying your first home in 2025 is more achievable than ever, with a 23.1% increase in available homes on the market and mortgage rates trending toward a more buyer-friendly 5.5%. Whether you’re dreaming of a downtown condo, a suburban starter, or a countryside retreat, this step-by-step checklist will help you navigate the process with confidence.

Pre-Buy Preparation

- Check Your Credit Score: Lenders typically look for a score of 620 or higher. Even a 50-point boost could shave 0.25% off your interest rate, saving you thousands over the life of your loan.

- Save for a Down Payment: Aim for 3–20% of the purchase price (that’s $9,000–$60,000 on a $300,000 home). Research local and national down payment assistance programs that can make this step easier.

- Assess Your Finances: Use the 28% rule—your monthly housing costs should be less than 28% of your gross income. Factor in not just your mortgage, but also insurance, taxes, and maintenance.

The Search and Offer Process

- Research Properties: Explore nationwide listings and use filters to narrow by price, location, and must-have features. Take virtual tours to preview homes before visiting in person.

- Get Pre-Approved: Secure a pre-approval letter from a reputable lender. This shows sellers you’re serious and can speed up the offer process.

- Work with a Trusted Agent: An experienced real estate agent can help you spot red flags, negotiate the best deal, and guide you through paperwork and deadlines.

- Make Your Offer: Lean on your agent’s expertise to craft a competitive offer, especially in popular neighborhoods. Don’t be discouraged by counteroffers—it’s all part of the process!

From Contract to Closing

- Schedule a Home Inspection: Hire a certified inspector to check for hidden issues. Use their report to renegotiate or request repairs if needed.

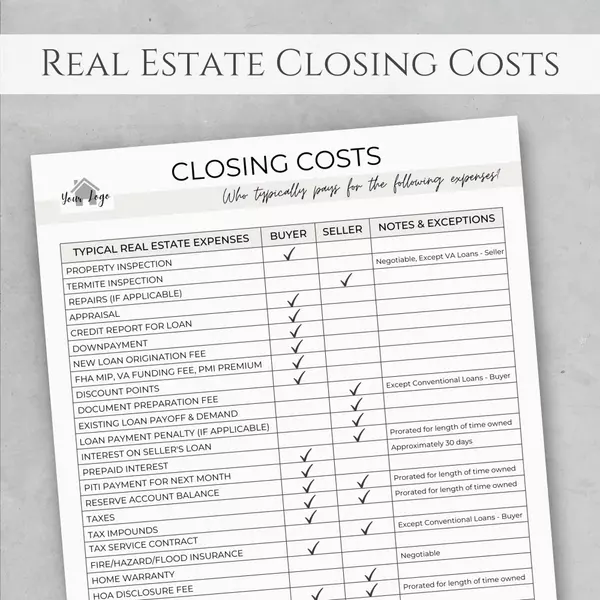

- Finalize Financing: Provide your lender with all required documents and lock in your rate. Review your Loan Estimate and Closing Disclosure carefully—know what you’re paying for.

- Get Homeowners Insurance: Shop around for coverage that fits your needs and budget. Lenders require proof of insurance before closing.

- Do a Final Walk-Through: Make sure the home is in agreed-upon condition and that any negotiated repairs are complete.

- Close and Get the Keys: On closing day, sign your documents, pay your closing costs, and get ready to celebrate—your new home awaits!

2025 Tips for First-Time Buyers

- Explore First-Time Buyer Programs: Many states and lenders offer grants, low-interest loans, or tax credits. Research your eligibility early in the process.

- Understand Market Trends: With more homes on the market and rates stabilizing, buyers have more negotiating power in 2025. Don’t rush—take time to find the right fit.

- Plan for Ongoing Costs: Budget for utilities, maintenance, and unexpected repairs. Building an emergency fund now will give you peace of mind later.

Ready to take the first step? With this checklist in hand, you’re well on your way to turning your homeownership dreams into reality in 2025.

Recent Posts

Understanding Closing Costs: Buyer's Financing Breakdown

Down Payment Assistance Programs Nationwide in 2025

How to Improve Your Credit Score for Better Mortgage Rates

FHA vs. Conventional Loans: Which is Right for You?

2025 Mortgage Rates Forecast: What Buyers Need to Know

Selling in a High-Interest Rate Environment: 2025 Tips

How to Price Your Home Right in a Shifting Market

Home Staging Tips for Maximum Value in 2025

2025 Seller's Market Trends: When to List Your Home

How to Budget for a Home in a High-Interest Rate Market